Resource Library

Here, you will find historical data, graphs, and other budget information.Past Communications

The University Leadership Team provided a budget update, and answered questions from attendees at the monthly UBAC meeting on February 18.

On January 29, 2026, The University Leadership Team provided a budget update for building a financially healthy campus.

The University Budget Advisory Committee and ULT hosted a special meeting on January 30, 2026 to further discuss the updates announced the day prior.

This past fall, we invited the campus community to participate in a budget process survey to share feedback on how we communicate and make decisions related to creating a financially healthy campus at UCCS. The feedback we received highlighted six key priorities for improving how we approach budget planning and decision-making.

The Budget Process Survey was conducted to gather perspectives from faculty, staff, and students on what has worked well in past budgeting processes, what should be avoided, how trust can be strengthened, which values should guide decisions, and any additional concerns or insights. The goal was to inform a more transparent, effective, and values-aligned budgeting process at UCCS. The report was shared on December 16, 2025.

FAQ

Current State and Historical Data

Our campus is in a place of challenge. We have real and ongoing budget issues that require our immediate attention and sustained work. The signs of financial distress outlined by the National Association of College and University Budget Officers (NACUBO) mirror issues on our own campus.

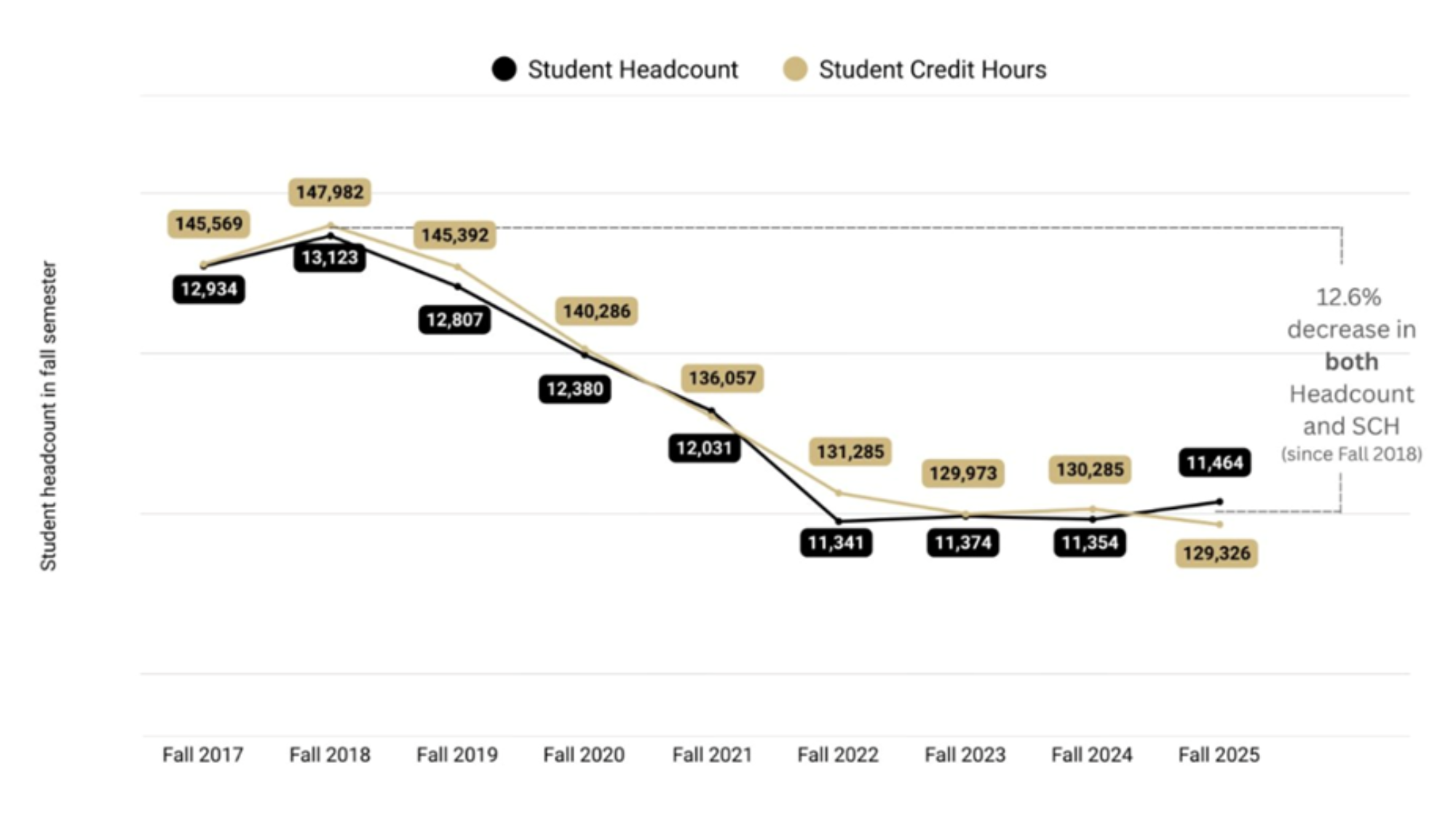

- Declining or unstable enrollment relative to expense base

- Repeated use of reserves to cover structural deficits

- Deferred maintenance or capital reinvestment delays that hurt the institution’s ability to deliver a quality experience for students and a supportive environment for academics

- Diminishing auxiliary margins that keep the institution locked in the status quo or worse

- Unclear financial practices at college and division level creating an unclear financial picture

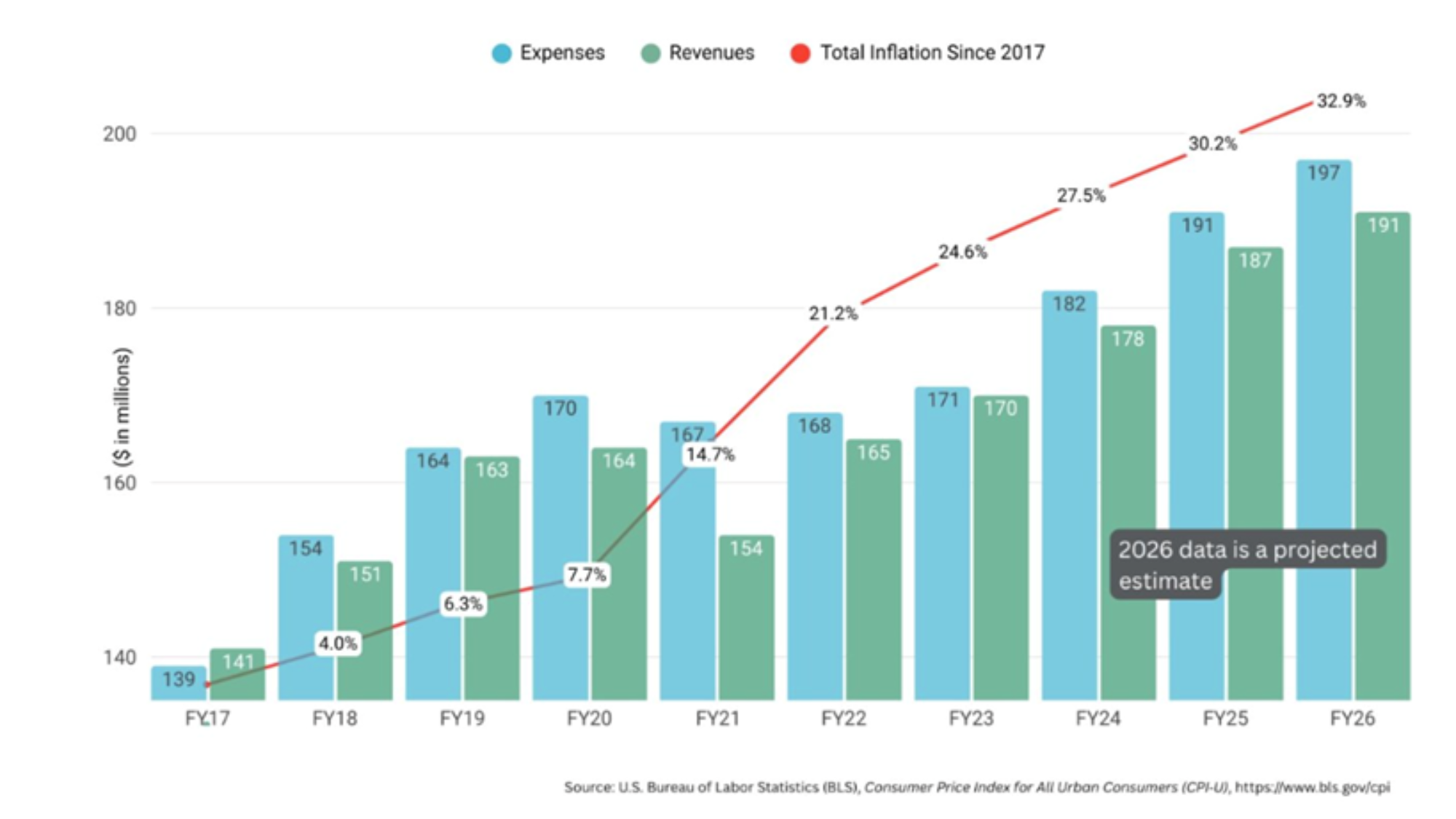

Specifically, our campus has experienced eight consecutive years of budget reductions and reallocations. Even with that work, we continue to experience revenue growth at only 2.62 percent which outpaces our expense growth at 3.34 percent.

We aren’t alone. Many institutions of higher education have experienced the same issues related to shrinking state support, growing competition, declining student enrollment, expanding expectations for enhanced student experiences and growing regulatory expenses.

Our Path Forward

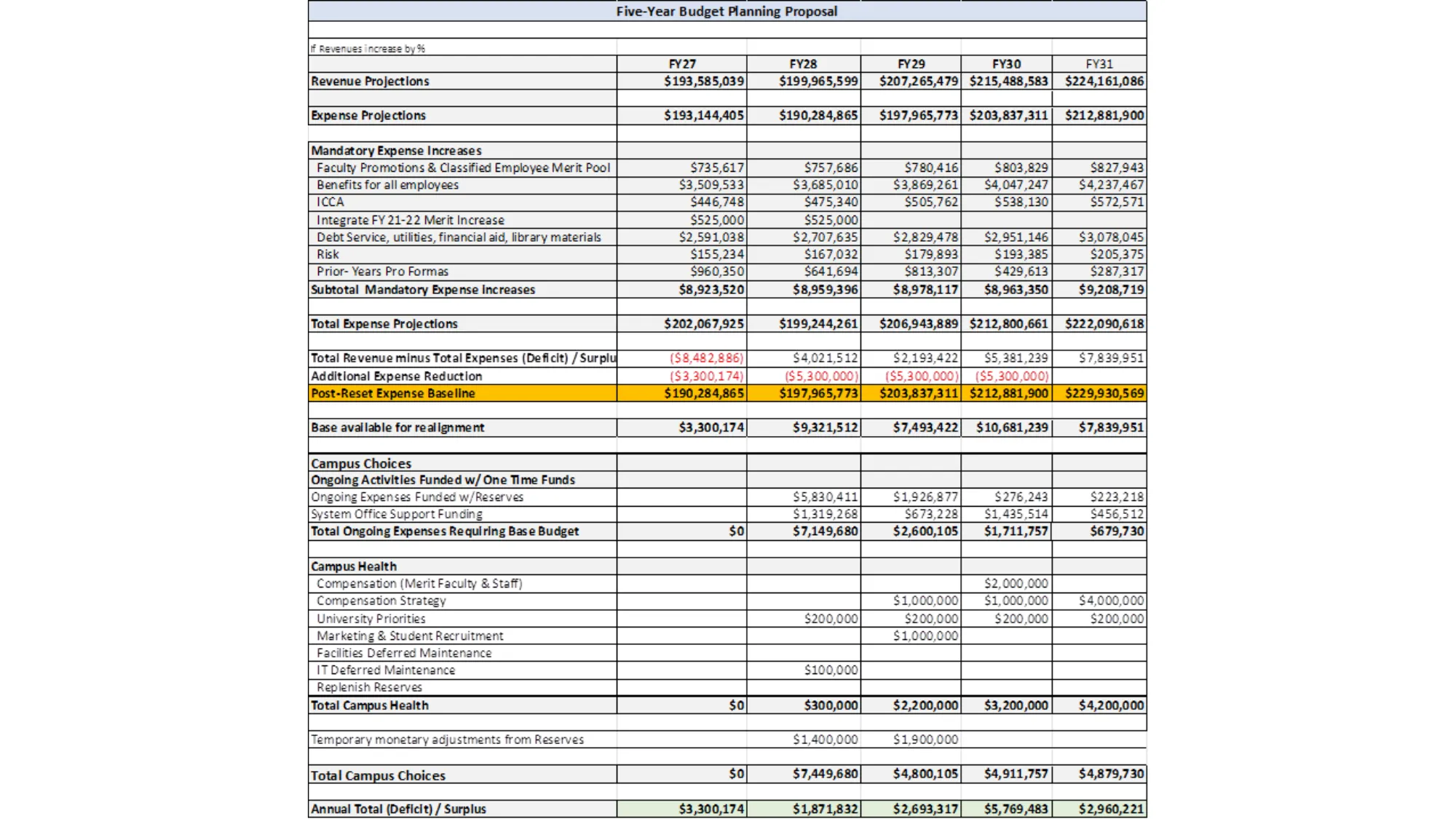

Right now, our gap is $27.7 million, which we will tackle over a five-year period. It is important to note that this number could change over the next few years as we implement our revenue and reallocation strategies. In the coming year, we will begin our budget reset and reduce spending by $11.7 million while we continue to focus on raising revenue. The size and scope of expense reductions in additional years will depend on the success of our strategies to increase revenue and ability to follow disciplined financial guideposts. Addressing our structural budget deficit and closing the gap means we must simultaneously raise revenue, reduce our spending, and reallocate resources in ways that will support our mission.

More details on our path forward will be coming soon.